Understanding the key differences between GST annual returns and monthly returns is crucial for compliance and effective tax management in 2025. Here’s a clear comparison, followed by why practical GST training at SLA Consultants India, New Delhi (110020), is valuable.

GST Annual Return vs. Monthly Returns: Key Differences, Get Practical GST Course in Delhi, 110020, by SLA Consultants India, New Delhi,

GST Annual Return (GSTR-9)

Purpose: Consolidates and summarizes all GST transactions (sales, purchases, ITC, tax paid) reported in periodic returns (GSTR-1, GSTR-3B, GSTR-2B) over the entire financial year.

Who Must File: Mandatory for registered taxpayers with annual turnover above ₹2 crore (except composition dealers and certain exempt categories).

Due Date: 31st December following the end of the financial year (e.g., for FY 2024-25, due by 31st December 2025).

Scope: Requires detailed reconciliation of all monthly/quarterly returns, disclosure of amendments, credit notes, ITC mismatches, and payment of any shortfall in tax or excess ITC claimed.

Complexity: More comprehensive, involving rigorous checks, supporting documentation, and often professional review.

Penalties: Late filing attracts separate late fees and can trigger scrutiny or audits.

Monthly (or Quarterly) GST Returns (GSTR-1, GSTR-3B)

Purpose: Regular reporting of sales (GSTR-1) and summary of tax liability, ITC, and payments (GSTR-3B) for each tax period.

Who Must File: All registered GST taxpayers; frequency (monthly or quarterly) depends on turnover and scheme (QRMP for small taxpayers). GST Course in Delhi

Due Dates:

GSTR-1: 11th of each month (monthly filers), 13th of the month after quarter (QRMP).

GSTR-3B: 20th, 22nd, or 24th of each month/quarter, depending on turnover and state.

Scope: Focuses on the current period’s transactions; less comprehensive than annual returns.

Complexity: Simpler, but must be accurate as errors roll forward to the annual return and can block ITC or cause compliance issues.

Penalties: Late fees and interest apply for delayed filing, and persistent delays can block further filings or ITC.

GST Annual Return vs. Monthly Returns: Key Differences, Get Practical GST Course in Delhi, 110020, by SLA Consultants India, New Delhi,

| Feature |

GST Annual Return (GSTR-9) |

Monthly/Quarterly Returns (GSTR-1, GSTR-3B) |

| Frequency |

Once a year |

Monthly or quarterly |

| Scope |

Consolidated summary of the year |

Periodic (month/quarter) transactions |

| Complexity |

High (requires reconciliation, audit) |

Moderate (transactional, ongoing) |

| Due Date |

31st Dec (following FY) |

11th/13th (GSTR-1), 20th/22nd/24th (GSTR-3B) |

| Penalties |

Separate late fee, possible audit |

Late fee, interest, ITC block, filing restrictions |

| Purpose |

Yearly compliance, audit, reconciliation |

Ongoing tax payment and credit flow |

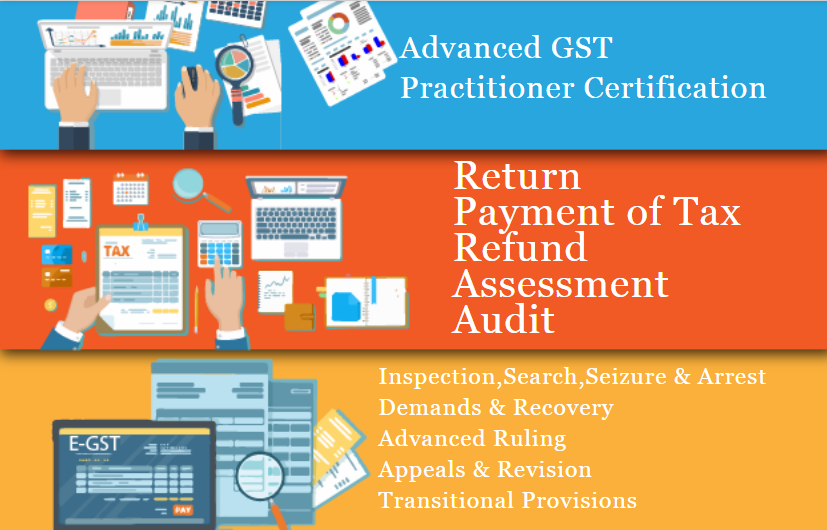

Why Take a Practical GST Course in Delhi (110020) by SLA Consultants India?

Real-world training on both annual and periodic GST return filing, reconciliation, and compliance.

Expert guidance on new 2025 rules, error prevention, and audit readiness.

Career advantage for finance, accounting, and compliance professionals910111213.

In summary:

GST annual returns (GSTR-9) provide a comprehensive, year-end reconciliation of all periodic returns, while monthly/quarterly returns (GSTR-1, GSTR-3B) handle routine reporting and tax payments. Both are mandatory and interconnected, making accurate and timely filing essential for compliance and business health in 2025.